Accelerating Revenue Recovery - Priorities for Hospitals in 2022

Longer hospital stays, sicker communities, staffing shortages, and a rising self-pay population may have led to nearly $54 billion in revenue loss in 2021, despite federal relief.

The State of the Hospital Revenues in 2021

The second calendar year of the raging pandemic had been much kinder to hospitals, with most hospitals reporting a decent rise in margins compared to the first year. However, the Kaufman Hall National Hospital Flash Report observes that the operating margins remained 3.8% lower than the pre-pandemic bottom lines. This report from the American Hospital Association (AHA) confirms that over one-third of hospitals across the country are operating with negative margins.

These numbers indicate the worrisome state of affairs that US health systems are experiencing. Indeed, hospitals and healthcare systems across America are under acute stress as they continue to face financial challenges just to stay afloat.

To continue staying in the black, hospitals must take advantage of every opportunity available to recover lost revenue, capture hidden coverages, and not leave money on the table.

Also Read:

In this article, let us explore the trends that challenge revenue recovery and how an automated insurance discovery solution can reverse these trends.

What Causes Hospitals to Lose Revenue?

Optimizing the revenue cycle and improving their bottom lines remain the top priority for most hospitals in the US in the post-pandemic world. However, the path to revenue recovery is quite steep, with several challenges to overcome.

Staffing shortages:

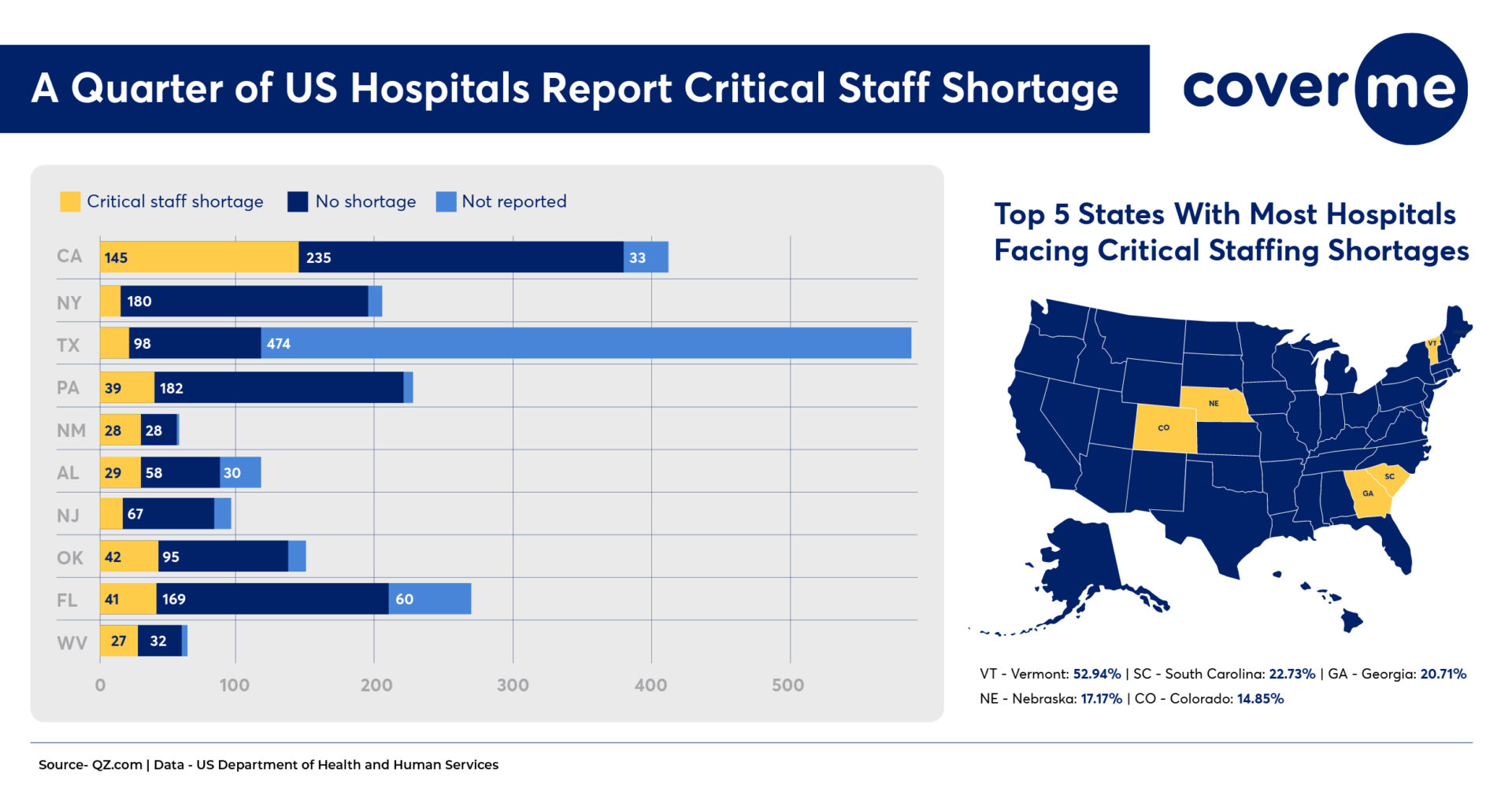

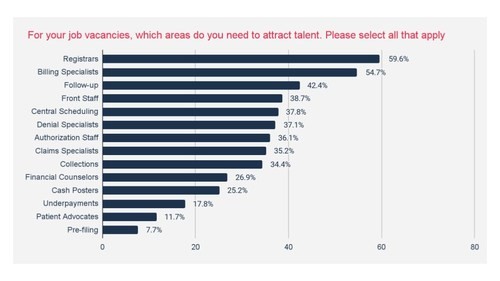

Talk to any healthcare leader in the US, and the top issue that they are likely to talk about will be the labor shortages. Most hospital CEOs are unanimously choosing staffing shortages as the topmost concern in 2022. A study conducted by Healthcare Financial Management Association (HFMA) claims that many hospitals struggle to maintain a stable workforce in the revenue cycle management processes.

Image source: PR Newswire

With the rising labor shortages, hospitals are turning to contract staffing and outsourcing, which ultimately increases the operating expenses and burns a hole in their margins. According to an AHA report, as of January 2022, the staffing expenses per patient were at least 57% more than what it was pre-pandemic.

Also Read: Rural Hospital Closures: How do They Impact the Country’s Economic Health?

Rising self-pay accounts

A 2020 Becker’s hospital CFO’s report observed that healthcare leaders anticipated an uptick in the number of self-pay accounts, and they were spot on in their predictions. More self-pay could imply a drop in commercial reimbursements. This makes it imperative that hospitals take every possible step to locate every coverage possible, more specifically, all those hidden or unknown coverages.

Sicker population:

Hospitals and health systems are facing more in-patient admission requiring a longer duration of stay. Such a scenario could ideally contribute to higher revenues. However, the gains are mostly offset by the higher costs of treating uninsured or underinsured patients with severe health conditions.

"Hospital patients in 2022 are likely sicker, harder to discharge and more expensive to treat than hospital patients in 2021," - Eric Stevenson, Sr Vice President of Data & Analytics, Kaufman Hall

As a result, the operating margins for hospitals are negatively impacted, causing an undue strain on their finances.

Time-consuming Coverage Discovery

While we stress the importance of finding every possible coverage opportunity, it is important to note that manual coverage discovery is often considered laborious and time-consuming. Manually searching and identifying billable opportunities can also place undue stress on the hospital administrators and can eat up productive labor hours. Compounding this, if the backend ends up billing the wrong payer, it might cause claim denials which may further delay reimbursements.

Burden of Uncompensated Care

Across the nation, uncompensated care is one persistent issue that continues to plague hospital finances. An AHA report confirms that US hospitals have provided over $660 billion towards uncompensated care since the year 2000. More recently, as of 2019, uncompensated care from US hospitals summed up to around $41.6 billion. As the number of uninsured Americans continues to rise, this number is only expected to grow, inducing more financial burden on the providers.

It should be noted that government financial assistance is available to fund uninsured patients. However, hospital systems are not really prepared to navigate through a complex web of public programs and funding streams to identify such available resources.

Thus, if the hospitals do not want to leave money on the table, it is critical they optimize their revenue recovery strategy to discover every billable opportunity.

A solid insurance discovery solution may hold the answer.

How can an Insurance Discovery Solution Maximize Hospital Revenues?

A successful revenue strategy cannot be executed in silos. It should take a holistic approach to simplify the process of reimbursements at every healthcare touch point. In fact, identifying coverage opportunities can begin well in advance, even before a patient receives care.

The conventional method of identifying billable coverage missed at point-of-care involves a labor-intensive approach to track down missed revenues and may most likely get written off as bad debts.

Further, most of the conventional insurance discovery solutions cater to uncovering what is due from the self-pay population alone. By doing this, most hospitals are missing out on an opportunity to maximize their revenue opportunities by looking out for all eligible coverage programs. A comprehensive coverage discovery solution should look beyond the self-pay receivables. It should take a holistic approach and pursue every available coverage opportunity from other patient populations, including Medicaid and other commercially insured patients.

Let’s now see how a technology-enabled insurance discovery solution from CoverMe can help:

CoverMe adopts a three-pronged strategy for insurance discovery to optimize revenue across at every stage of the revenue cycle.

Insurance verification:

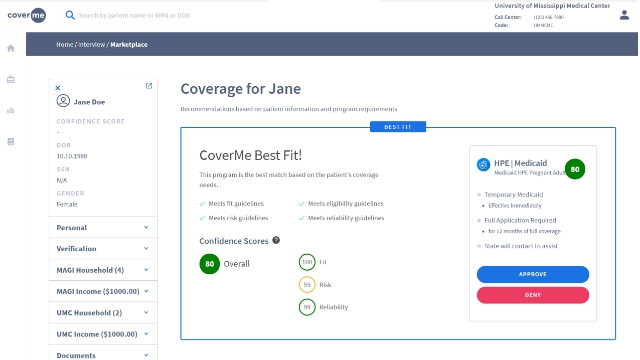

This includes pre-service checks to verify and validate if the patient has existing coverage. CoverMe’s real-time insurance verification system scans multiple commercial databases to validate the patient’s demographic information and identify any unknown coverage. At this point, CoverMe can also help detect any data discrepancies that can lead to denied claims, which in turn could cause a delay in reimbursements.

Insurance discovery:

In the absence of existing coverage, the CoverMe algorithm uses patient data and discovers all possible coverage options - government or commercial. It further analyzes the patient’s propensity to pay and draws a best-fit coverage program that includes hospital financial assistance (tailored to match your hospital’s financial assistance policy), self-pay balance financing, and charitable care.

Retrospective coverage discovery:

Finally, for any pending patient receivables, the CoverMe Retrocheck solution identifies all billable Medicaid, Medicare, and commercial insurance that were previously unknown, hidden, or forgotten. CoverMe Retrocheck can help identify and recapture all missed reimbursements from 90 days to 1 year post-discharge. The system can also handle batch processing so that you can uncover details for multiple patients at once, thus saving time and resources.

Under all the above scenarios, CoverMe provides an automated solution that eliminates the manual scrubbing required to identify these coverage opportunities. This ensures that administrative staff are not overwhelmed and can instead use their time more efficiently.

Maximize Your Revenues with CoverMe

Insurance discovery is just one critical component of the hospital financial management solution. In addition to a comprehensive insurance discovery solution, CoverMe offers a full suite of healthcare finance marketplace solutions that can help you fix revenue leakages, improve cash flows, reduce patient bad debts and enhance the overall patient experience. Talk to us to learn more about how CoverMe can help your healthcare organization. Schedule a demo today!