Why take the risk of unpaid patient bills when you can leverage CoverMe's data-driven strategy to pre-approve patients for flexible financing options? CoverMe delivers a simple solution that improves the cash flow to your healthcare organization and provides your patients with affordable payment opportunities to meet their healthcare expenses.

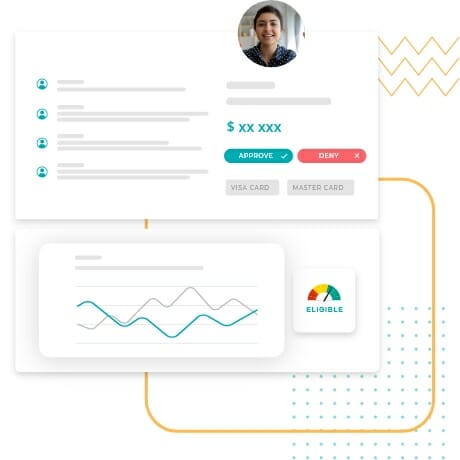

Our Patient Financing services help patients pre-secure options to meet their financial obligations. CoverMe makes the eligibility process a more positive patient experience by offering pre-approved financing pathways based on unique financial situations and other parameters such as family size, household income, etc.

CoverMe offers patient financing programs at a zero-percent or low-interest rate for patients to pay their portion of healthcare costs.

Easy Pre-Approval Process

Affordable payment options through Interest-free, low-interest, and line of credit options - all available for pre-approval to reduce the pressure of uncertain medical expenses.

Effective Patient Financing Program

Flexible recourse and non-recourse programs for providers to streamline payment collections and improve patient confidence.

Customized Payment Plan:

Full-suite of customized financial plans to help you meet your ROI objectives and ensure financial coverage to meet the healthcare costs of patients.

Our patient financing solutions keep patients and providers covered

We are not a lender. We provide a technology platform that connects healthcare providers and patients to lenders to enable flexible financing options for healthcare treatments. We look for financing programs that help your patients to pay their out-of-pocket expenses.

CoverMe helps you to offer your patients more financial flexibility. For patients with a self-pay balance, CoverMe verifies their eligibility for different financing programs and discovers options that are most suitable for them. Your patients can access the payment option that works best for their budget with our wide range of loan options - zero or low-interest loans, line of credit, etc.

Absolutely. CoverMe is HIPAA compliant and maintains data integrity and ensures all the information is safe and secure.

CoverMe delivers solutions that are scalable for health care facilities, irrespective of their size or specialty. We work with hospitals, clinics, independent practitioners and long-term care facilities to name a few.