Insurance eligibility verification is the first and most important step in the healthcare insurance and medical billing procedure. Unfortunately, this process is often mired in confusion and misinterpretation despite its prominence. To top that, many healthcare providers do not pay attention to the specifications of the verification process. As a result, claim denials happen, and the patient does not gain any benefits when battling a health crisis and mounting medical bills.

Lack of awareness cannot be an excuse for an unsuccessful verification process. Everyone needs to understand this process because a health crisis often comes without warning. You don't want to be caught unawares when you or your loved ones require hospital care. So let's first check out the definition of eligibility verification.

Eligibility Verification is when the patient's insurance eligibility status is determined by checking three different statuses: coverage, active or inactive status, and eligibility. It is crucial to verify insurance eligibility to prevent claims denials and payment delays, especially regarding the Account Receivables (AR).

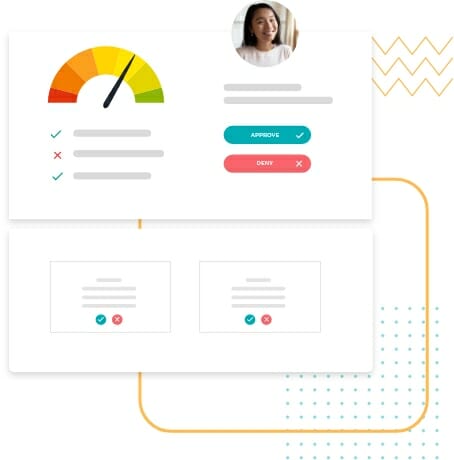

CoverMe's health insurance verification system is designed to provide a quick assessment of eligibility. This automated platform effortlessly corroborates vital data concerning the patient's insurance coverage. It finds and fixes issues to improve overall patient intake and communication.

Eligibility Verification bestows you with the following benefits:

Verifying benefits and coverage can be quite challenging considering the high patient deductibles and constantly changing plans. This affects productivity, and worse, it frustrates patients. Before medical care providers begin treating their patients, they must verify all their insurance coverage and benefits. That way, errors can be avoided while filing for insurance reimbursements.

The trick is to work smarter and not harder. Several factors ensure patients' insurance eligibility, including minimizing claim rejections and the likelihood of delayed payments. The next part of our article lists some proven practices to expedite and enhance the eligibility verification process.

1. Gather data from all sources

Data is the key component for verification. Comprehensive and accurate data can simplify and expedite the process. Therefore, to obtain valid information, you must identify all sources from which you can collect it. Here's a list of the basic details that you should not miss:

2. Cross-check the collected data

Once you've successfully collected the data, you should not submit it right away. Instead, you should cross-check every detail with the insurance provider and the data in your system. All details should be accurate and real-time. There is no room for compromise here.

Inaccurate and outdated data will derail the successful execution of the verification process. No insurance company will accept data that isn't sound, solid, and accurate. It will be rejected right away or kept on hold for long periods, resulting in heavy financial loss.

3. Find the gaps

Once the data is collected and analyzed, the next step is to carry out the follow-ups to find the missing pieces of information. Here again, you need to find the right information sources and arrange for follow-ups to find every missing bit of data.

4. Talk to the payers

There is no point in moving ahead with the process without talking to the respective payers. This effort will help you identify any possible discrepancies collected from the patient and insurance provider.

5. Get pre-authorized approvals

To enhance the patients' experience and prevent claims denials later in the process, it is best to obtain pre-authorization approvals whenever possible. With the approvals in hand, you can confidently move to the other stages of the process.

6. Opt for automation

Ditch your manual practices and invest in real-time data analytics tools. Referring to real-time updated data will improve your data management speed and accuracy. Moreover, these tools will help you access a variety of payers all under one roof to view real-time information about any patient at any time.

7. Educate your patients

How much does your patient know about their insurance plan details, responsibilities, and coverage? The truth is a very small percentage of patients are well-informed about these details. Most of them are even unaware of the changes introduced by their insurance provider. Many patients are caught unawares when the truth about out-of-pocket expenses hits them. Unfortunately, no patient likes such nasty surprises and such incidents often jeopardize the relationship between the patient and the service provider.

Therefore it is the provider's responsibility to keep the patient updated and well-informed about all the expenses and benefits.

8. Outsource the verification process

Eligibility verification is a job for experts. Why burden your staff with this complex process when you can easily hire professionals for the job? Subject matter experts can guide you through every stage of the insurance verification process with the utmost confidence, competence, and clarity. Besides, they also have the experience of dealing with many clients. Hence, they can identify gaps and complete the procedure faster than you know it.

Deal with your insurance eligibility verification process by making a smart move with CoverMe. As a well-known healthcare finance marketplace in the US, CoverMe can provide customized solutions to increase productivity through real-time eligibility. CoverMe does it all, whether it is filling the missing gaps, talking to insurance providers, or connecting with community resources. If delivering a better patient experience with benefits is the goal, no one does it better than CoverMe. Call us to schedule an appointment or request a demo.